vermont income tax brackets

Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. W-4VT Employees Withholding Allowance Certificate.

United States Settlement Patterns Map American History Timeline United States

The state income tax rate in Vermont is progressive and ranges from 335 to 875 while federal income tax rates range from 10 to 37 depending on your income.

. Vermont has a graduated individual income tax with rates ranging from 335 percent to 875 percent. PA-1 Special Power of Attorney. Vermont collects a state corporate income tax at a maximum marginal tax rate of 8500 spread across three tax.

Vermonts income tax brackets were last changed two years prior to 2020 for tax year 2018. 4 rows Vermonts income tax brackets were last changed two years prior to 2020 for tax year 2018. For more information about the income tax in these states visit the Vermont and Connecticut income tax pages.

As an employer you must match this tax. 2017-2018 Income Tax Withholding Instructions Tables and Charts. Any income over 204000 and 248350 for.

Vermont also has a 600 percent to 85 percent corporate income tax rate. Vermonts income tax brackets were last changed one year prior to 2003 for tax year 2002 and the tax rates have not been changed since at least 2001. Vermont Tax Brackets for Tax Year 2020.

2021 Vermont Tax Tables. This tool compares the tax brackets for single individuals in each state. These taxes are collected to provide essential state functions resources and programs to.

Before the official 2022 Vermont income tax rates are released provisional 2022 tax rates are based on Vermonts 2021 income tax brackets. 2017 VT Tax Tables. For Social Security tax withhold 62 of each employees taxable wages until they have earned 147000 in a given calendar year.

As you can see your Vermont income is taxed at different rates within the given tax brackets. Vermont State Personal Income Tax Rates and Thresholds in 2022. 2017-2018 Income Tax Withholding Instructions Tables and Charts.

Discover Helpful Information And Resources On Taxes From AARP. The latest available tax rates are for. Your 2021 Tax Bracket To See Whats Been Adjusted.

5 rows The Vermont income tax has four tax brackets with a maximum marginal income tax of. 2016 VT Rate Schedules and Tax Tables. We last updated Vermont Tax Rate Schedules in March 2022 from the Vermont Department of Taxes.

On an annual basis the department and IRS conduct a cross match to ensure that employers are paying both taxes. W-4VT Employees Withholding Allowance Certificate. Vermont School District Codes.

2019 Income Tax Withholding Instructions Tables and Charts. Vermont has four tax brackets for the 2021 tax year which is a. The major types of local taxes collected in Vermont include income property and sales taxes.

The states top tax rate is 875 but it only applies to single filers making more than 206950 and joint filers making more than 251950 in taxable income. 2017 VT Rate Schedules. PA-1 Special Power of Attorney.

More about the Vermont Tax Tables. Complete IRS Tax Forms Online or Print Government Tax Documents. Vermont School District Codes.

IN-111 Vermont Income Tax Return. This form is for income earned in tax year 2021 with tax. Ad Compare Your 2022 Tax Bracket vs.

We last updated Vermont Tax Tables in March 2022 from the Vermont Department of Taxes. IN-111 Vermont Income Tax Return. W-4VT Employees Withholding Allowance Certificate.

IN-111 Vermont Income Tax Return. Tax Rate 0. Vermont state income tax rate table for the 2020 - 2021 filing season has four income tax.

Tax Bracket Tax Rate. If youre a single filer with 40950 or. PA-1 Special Power of Attorney.

5 rows Vermont Income Taxes. Provided the state does not have any outstanding Title XII. Vermont School District Codes.

This form is for income earned in tax year 2021 with tax returns due in April 2022We.

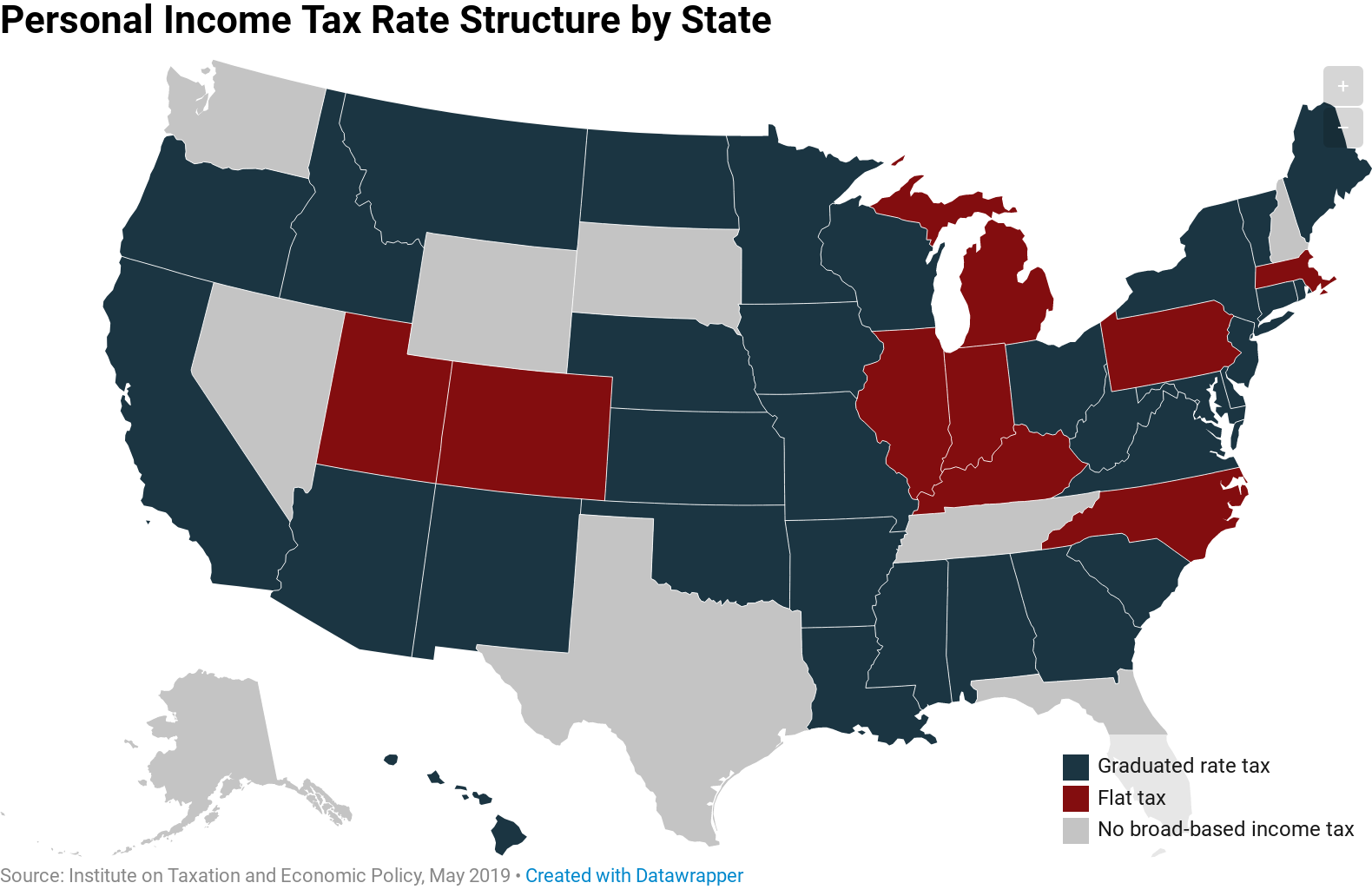

Center For State Tax Policy Tax Foundation

The 10 Best States For Retirees When It Comes To Taxes Retirement Retirement Locations Retirement Advice

The Best And Worst U S States For Retirement Best Places To Retire Retirement Retirement Community

Lili S Tax Resources Tools And Tips To Simplify Tax Season Lili Banking

Why New England Is Better Than Florida Visiting England New England Travel England Travel

File Top Marginal State Income Tax Rate Svg Wikipedia

State Corporate Income Tax Rates And Brackets Tax Foundation

Monica Haven Your Taxpayer Advocate State Map

Vermont Income Tax Calculator Smartasset

Center For State Tax Policy Tax Foundation

This Map Explains Why Midwesterners Find New Yorkers Weird History Mystery Of History Historical Maps

Idaho Tax Rates Rankings Idaho State Taxes Tax Foundation

Map State Sales Taxes And Clothing Exemptions Trip Planning Sales Tax Map